This content was originally explored during a webinar with EnergyCAP, featuring Verdantix, alongside Smart Energy Decisions. You can watch a recording here. The content within this eBook has been restructured for clarity, and some areas have been expanded upon for greater insight.

Content contributor introductions

Verdantix is a research and advisory firm that acts as an essential thought-leader for world-enhancing innovation. Together with their customers, they shape markets, define the technologies of tomorrow, and future-proof businesses. Some areas of focus include:

- Environment, health, and safety

- ESG and sustainability

- Net-zero and climate risk

- Operational excellence

- Risk management

- Real estate and built environment

Smart Energy Decisions (SED) is the first web-based information resource dedicated exclusively to addressing the information needs of large power customers within commercial, industrial, institutional (higher education and healthcare), and government organizations. They deliver news, analysis, research, and opinion through newsletters and events to help our community make better decisions.

SED’s goal is to serve as a catalyst for change in support of the dramatic energy transformation taking place in the electric power market that impacts energy customers, utilities, and suppliers.

During the webinar, Jessica Pransky, Principal Analyst at Verdantix, joined EnergyCAP’s Vice President of Marketing, Amber Artrip alongside Debra Chanil, Research & Content Director at Smart Energy Decisions, to discuss the latest climate regulations and gain best practices for compliance.

State of ESG reporting

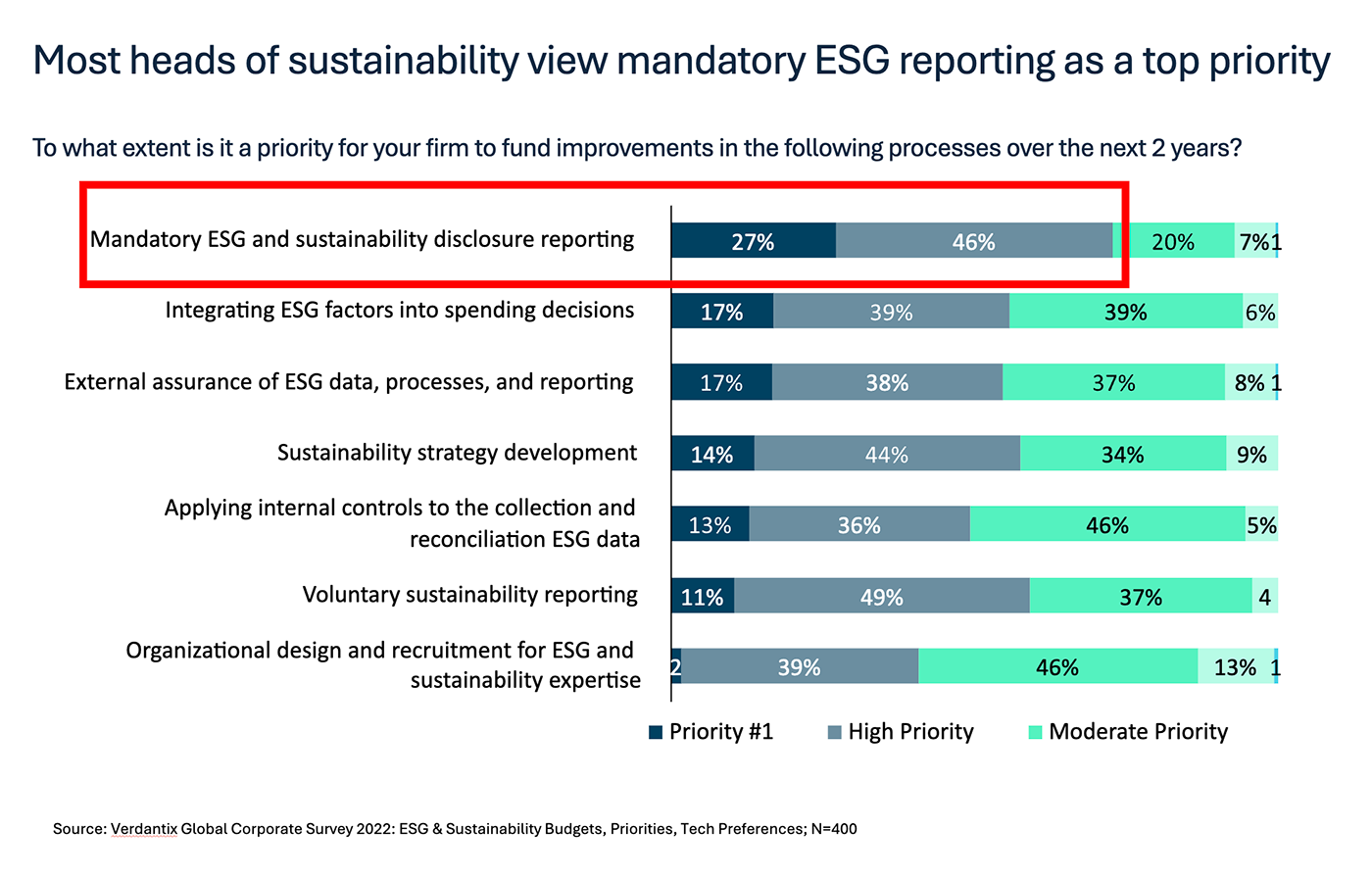

During the live webinar, attendees were tasked with answering the following poll:

Most heads of sustainability view mandatory ESG reporting as a top priority. Which of the follow in the highest priority for your firm to fund improvements in the following processes over the next 2 years?

Option 1: Mandatory ESG and sustainability disclosure reporting Integrating ESG factors into spending decisions External assurance of ESG data, processes, and reporting

Option 2: Integrating ESG factors into spending decisions External assurance of ESG data, processes, and reporting

Option 3: External assurance of ESG data, processes, and reporting

What is going on with the SEC?

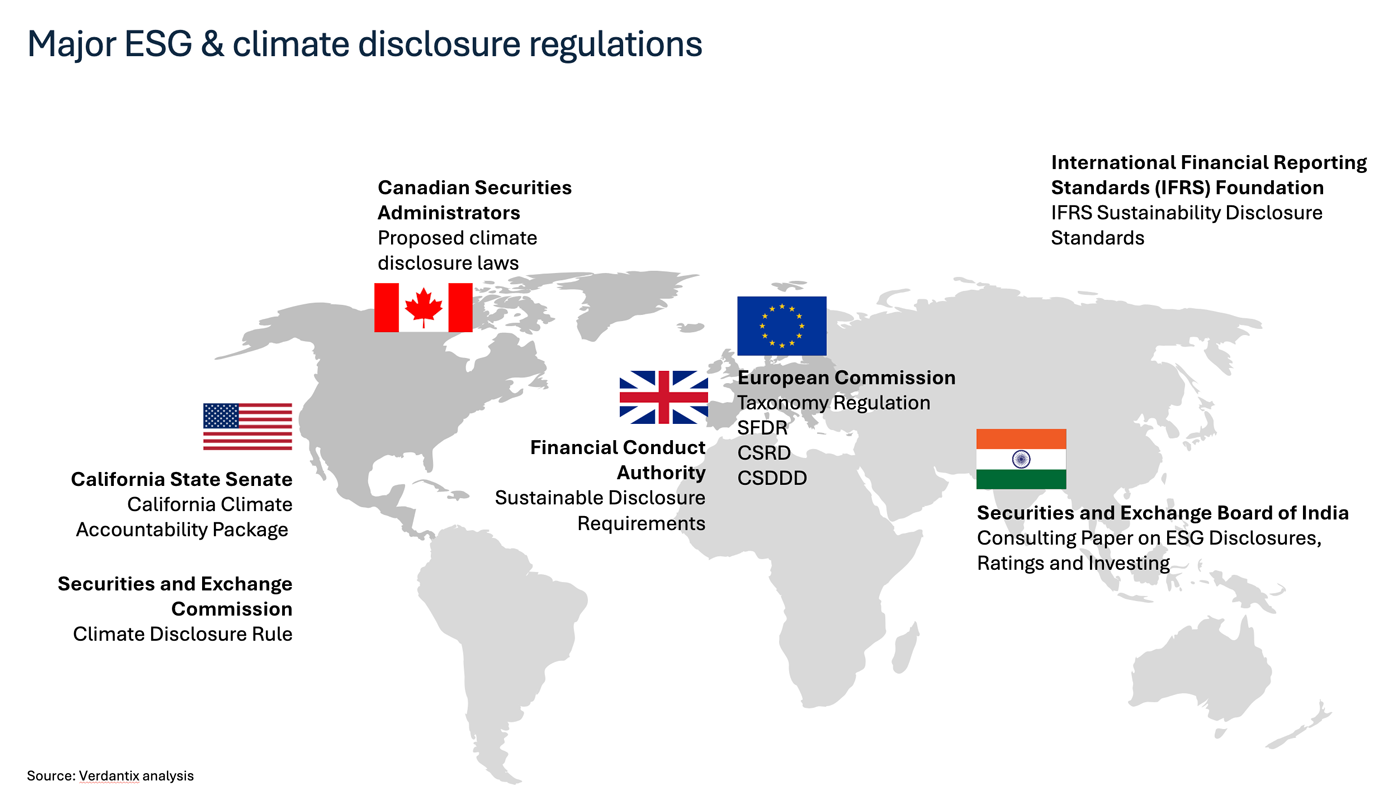

In recent years, the U.S. Securities and Exchange Commission (SEC) has exhibited a growing interest in obtaining more comprehensive Environmental, Social, and Governance (ESG) and climate-related data from publicly listed companies. This resulted in the SEC’s own task force on climate and ESG in 2021, followed by a proposed climate disclosure rule in March 2022.

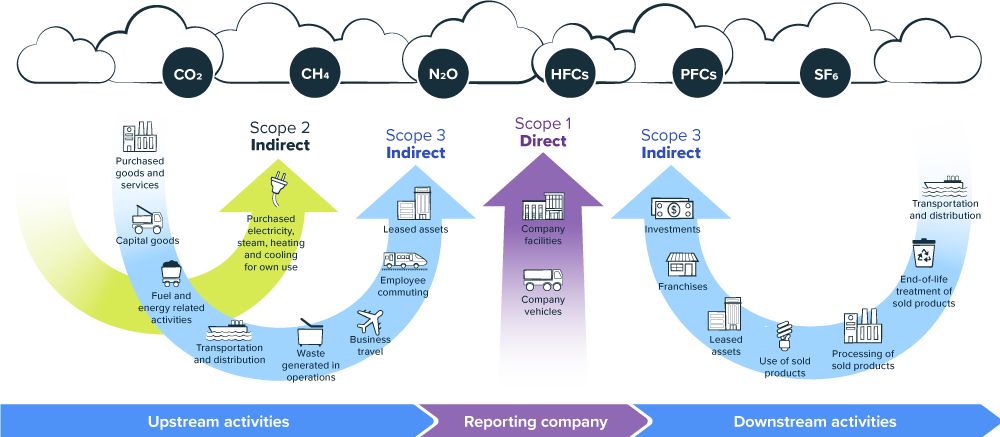

This proposal has been widely discussed and scrutinized, especially for its requirement for companies to disclose their Scope 1, 2, and 3 emissions, obtain assurance on these emissions, and disclose specific climate-related risks.

When the SEC opened up a comment period, they received over 14,000 comments, many of which raised concerns about the burden of including scope three emissions. This feedback led to delays in the rule’s implementation.

By March 2023, the SEC had finalized its climate disclosure rule, which then faced several lawsuits from various organizations. As a result, in April 2024, they voluntarily stayed its rule to focus on defending it in court. Despite these challenges, the SEC believes that there is sufficient investor pressure to support the enforcement of these rules eventually.

The key elements of the final rule emphasize financial materiality, requiring publicly listed companies to report their scope 1 and scope 2 emissions if deemed material, though the term “material” remains somewhat ambiguous. The rule also mandates that these emissions be verified by an independent third party. Additionally, companies must disclose their climate-related targets, plans, scenario analyses, and the financial impacts of extreme weather events such as flooding, hurricanes, and wildfires.

While the timeline for implementation remains uncertain due to ongoing litigation, the SEC’s commitment to advancing these climate disclosure requirements is evident.

Unpacking SB 253 and SB 261

In October of 2023, California enacted two significant climate disclosure laws—SB 253 and SB 261—aimed at enhancing corporate transparency regarding environmental impact and climate-related risks.

SB 253 mandates that companies disclose their carbon emissions, encompassing scope 1, scope 2, and scope 3 emissions. These disclosures are to be reported to the California Air Resources Board (CARB), which will also enforce compliance with potential severe penalties for non-compliance. Unlike the SEC’s climate disclosure requirements that apply only to publicly listed firms, SB 253 applies to both publicly listed and privately held companies doing business in California with annual revenues exceeding one billion dollars.

Approximately 5,300 firms are expected to be affected by this regulation. Companies will need to secure assurance for the reported data, starting with limited assurance and eventually transitioning to reasonable assurance.

SB 261, on the other hand, addresses climate-related risks that companies may face. Under this law, firms are required to identify and report the physical and transitional risks associated with climate change and outline their adaptation strategies.

Physical risks could include extreme weather events like droughts and hurricanes, while transition risks involve adapting to a green economy through technological advances and shifts in consumer preferences. This regulation aligns with the Task Force on Climate-related Financial Disclosures (TCFD) and similar international efforts. The goal is to protect consumers and investors from potential losses due to climate disruptions, such as supply chain issues and infrastructure challenges.

Companies affected by SB 261, which include those with annual revenues exceeding $500 million, must prepare a report detailing these risks and post it on their website, with severe penalties for non-compliance. The state estimates that around 10,000 firms will fall under this regulation. Together, these laws underscore California’s commitment to addressing climate change through rigorous corporate disclosure and accountability, covering many firms operating within the state.

The regulations regarding climate risk reporting are set to be implemented swiftly, with the first reports due to the state by January 1, 2026. Companies will need to report their scope 1 and 2 emissions for the year 2025 by an unspecified date in 2026. Scope 3 emissions and assurance requirements will be phased in later.

In June 2024, Governor Newsom issued a new proposal that would delay implementation of these requirements by two years–although it is unclear if these delays will be adopted. Notably, there is ambiguity around the phrase doing business in California, which is expected to be clarified in the coming months as well as whether there will be delays to reporting deadlines. Additionally, funding is an issue, as Governor Newsom delayed funding to the California Air Resources Board (CARB) earlier this year, though he indicated a potential reallocation of funds. Lastly, the enforcement of these regulations poses a challenge, particularly in ensuring compliance among the over 10,000 firms potentially subject to SB 261.

CSRD and beyond

The Corporate Sustainability Reporting Directive (CSRD) aims to enhance the quality of sustainability reporting starting in the European Union (EU). This directive is set to replace the existing Non-Financial Reporting Directive (NFRD), which previously applied only to the largest firms within the EU.

CSRD was developed partly in response to demands from investors for high-quality, investor-grade data that is accessible to various stakeholders. Its scope is significantly broader than the NFRD, impacting approximately 50,000 firms within the EU by 2027 and an additional 10,000 firms outside the EU by 2028. Notably, around 3,300 of these non-EU firms are estimated to be based in the United States.

CSRD will be implemented through a phased approach. Companies currently subject to the NFRD will need to start reporting in 2025, based on data from 2024. Non-EU firms, on the other hand, will begin reporting in 2029, based on data from 2028. This gradual implementation underscores the importance for all affected firms, both within and outside the EU, to prepare for the impending changes in sustainability reporting requirements.

CSRD presents a complex set of requirements that distinguishes it from other regulations such as those enforced by the U.S. Securities and Exchange Commission (SEC) and the state of California. One of the primary elements that makes the CSRD particularly challenging is the ESRS framework. This framework requires companies to report on a wide range of environmental, social, and governance (ESG) topics. It goes beyond just carbon emissions and climate risk data, extending to aspects like energy usage, water discharges, and various social metrics.

Another critical aspect of the CSRD is the concept of double materiality, which mandates companies to report on issues considered material from both an outside-in and inside-out perspective, encompassing both impact materiality and financial materiality. Similar to the SEC and California requirements, companies under the CSRD must also obtain third-party assurance of their data, starting with limited assurance and eventually progressing to reasonable assurance.

Additionally, companies are required to report across their entire value chain, including scope 3 emissions, which often pose significant challenges. Finally, the CSRD mandates that firms report on both their historical emissions and their future plans, including medium and long-term targets for 2030 and 2050.

Starting in 2025, European companies will need to comply with new ESG disclosure regulations, while U.S. and Canadian firms will begin facing similar requirements in 2028. The SEC mandates apply solely to publicly listed firms, whereas the Corporate Sustainability Reporting Directive (CSRD) includes both public and private companies. One notable aspect of these regulations is the assurance requirement, necessitating firms to validate their data before reporting. This emphasis on data reliability underscores the importance of accurate and auditable information.

In addition to the SEC and CSRD regulations, in 2021, the Canadian Security Administration proposed climate-related disclosure requirements aligned with the Task Force on Climate-related Financial Disclosures (TCFD).

This initiative by the CSA underscores the growing global emphasis on transparency and accountability in corporate environmental practices. The TCFD framework is internationally recognized for its comprehensive approach to assessing and managing climate-related risks and opportunities. By aligning with the TCFD, the CSA aims to enhance the comparability and consistency of climate-related financial disclosures across Canadian markets, thereby aiding investors in making more informed decisions.

TCFD is particularly important for several reasons:

First, it promotes a standardized approach to reporting, which helps mitigate the risks associated with fragmented and inconsistent disclosures. Investors and stakeholders can better compare the environmental performance and resilience of different companies, leading to more effective capital allocation.

Second, the focus on climate-related risks and opportunities encourages companies to adopt more sustainable practices, ultimately contributing to the global effort to combat climate change. By requiring disclosures related to governance, strategy, risk management, and metrics and targets, the CSA ensures that companies consider climate-related issues at the highest levels of decision-making.

Other mandates include reporting greenhouse gas emissions for government suppliers and contractors, disclosing plastic usage, and supply chain transparency laws addressing child labor, forced labor, and human rights issues.

All these regulations demand investor-grade data, characterized by accuracy, auditability, timeliness, and automation. Verdantix emphasizes that transitioning from operational data to investor-grade data often requires robust software solutions. Despite some firms still relying on manual processes, regulatory compliance will increasingly necessitate advanced data management tools.

How can EnergyCAP help?

EnergyCAP is recognized as a leading energy and sustainability software, differentiated by its financial-grade data quality and management.

EnergyCAP is committed to providing auditable, trackable, and reliable data at the core of its operations. With a user base exceeding 10,000 energy and sustainability professionals across the world, EnergyCAP processes over $20 billion in vendor bills annually and saves the majority of customers save 10% or more on utility costs.

EnergyCAP consolidates disparate energy and sustainability data, which may be scattered across different teams, systems, or spreadsheets, into one comprehensive platform. This unification allows users to analyze and ensure data accuracy, better manage energy consumption, reduce carbon emissions, and achieve financial savings.

EnergyCAP is built around three core components, which can be used individually or together, depending on a client’s sustainability journey and data needs:

- EnergyCAP UtilityManagement specializes in utility bill vendor data management, comprehensive energy and sustainability reporting at the portfolio level.

- EnergyCAP SmartAnalytics, a real-time analytics tool, provides deep insights into building operations using machine learning to detect anomalies and trends.

- EnergyCAP CarbonHub, a financial-grade greenhouse gas (GHG) accounting tool designed for organizations to track and report emissions data in compliance with mandates.

- Bill CAPture services, which helps customers streamline the integration of utility bill data into the platform, ensuring timely and accurate data for audit purposes.

EnergyCAP CarbonHub is particularly noteworthy for its flexibility in handling scope 1, 2, and 3 GHG data from various sources, including spreadsheets and API integrations. It supports custom and standard emission factors, offering historical tracking and auditing capabilities. The platform also features dedicated hierarchies that allow users to organize and view data according to their specific needs, providing tailored insights for different stakeholders within an organization.

If you’re looking to dive deeper into how this data might be accessible and helpful for your organization, EnergyCAP offers a free, self-guided demo of the CarbonHub tool, allowing you to explore the platform independently.

More resources: