FAQs from the webinar “Climate Regulations Are Coming–Are You Ready?”

In today’s rapidly evolving regulatory landscape, staying ahead on climate mandates is not just smart–it’s imperative. The webinar, “Climate Regulations Are Coming–Are You Ready?” from EnergyCAP and Verdantix, in collaboration with Smart Energy Decisions, provided in-depth insights into the current regulatory framework, actionable best practices in carbon accounting, and more.

Numerous important questions were posed during the webinar’s live Q&A. Although we couldn’t address all of them in real-time, we didn’t want to leave any inquiries unanswered. Below, you’ll find the answers to today’s climate regulation-related questions!

Can you expand on potential regulations for the real estate industry, for example, commercial buildings?

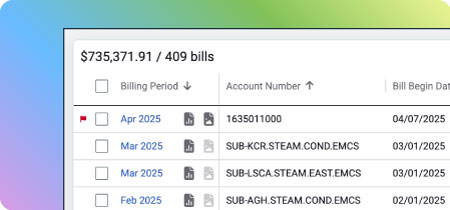

For the real estate sector, the regulations we discussed in this webinar (CA climate regulations, the SEC, CSRD, etc) can apply to firms that are in the real estate sector. However, many regulations for commercial buildings are coming at the local state or city sector. These laws are a little more nuanced, but those are some great places to start your research. You can learn more about how EnergyCAP’s energy and sustainability ERP gives Commercial Campuses instant access to actionable data here.

International and large corporations are already moving down this road, what do think it will be the drivers for mid-size/smaller companies to begin integrating ESG into their business plans?

Investor demand is a big driver right now—it seems to be second to mandatory reporting requirements. Investors are demanding this data, and we are seeing pressure from boards as well. On the regulatory side of things however, CSRD has a value chain requirement, so even if you’re a small firm and not directly subject to reporting anytime soon, others in your supply chain (upstream or downstream) might be pressuring small and mid-sized companies to report, even before reporting requirements catch up.

Is compliance enough, or should organizations be considering going for high performance on ESG?

Anyone who has started to go through the data collection process knows that it is cumbersome. If you’re gathering this data and using it only for reporting, you’re missing the bigger piece of the puzzle. It is really just the first step. You can use it to drive different business decisions, inform different stakeholders, etc. Moving beyond the reporting/compliance mindset it key. In a 2023 survey from Verdantix, less than 10% of respondents said they were using data just for reporting. If you want to meet the goals and targets that are being set, you are going to need more granular data to understand what is happening in order to make operational changes towards efficiency.

Can you confirm that Public Agencies (Local Gov) are not subject to SB 253?

The text of SB 253 defines a reporting entity as “a partnership, corporation, limited liability company, or other business entity formed under the laws of this state, the laws of any other state of the United States or the District of Columbia, or under an act of the Congress of the United States with total annual revenues in excess of one billion dollars ($1,000,000,000) and that does business in California.”

How do these regulations impact me, a site facilities manager?

You may soon be on the hook for reporting emissions information to leadership. You will want to prepare by ensuring you have data available to answer these types of emissions reporting questions as they arise.

Please spell out acronyms – CSRD, NFRD, etc.

CSRD – Corporate Sustainability Reporting Directive

The Corporate Sustainability Reporting Directive (CSRD) requires companies to report on the impact of corporate activities on the environment and society, and requires the audit (assurance) of reported information. EU Green Deal.

NFRD – Non-Financial Reporting Directive

The NFRD is a regulatory framework adopted by the European Union in 2014 that requires large companies to publish non-financial reports on their environmental, social, and governance (ESG) performance.

You can find more about European climate regulations here.

Could you speak to the need and demand for third-party verification of ESG data?

Many of the upcoming climate and sustainability-related disclosures, including the CSRD, SEC’s climate-related legislation, and California’s SB 253, require firms to obtain independent assurance of sustainability disclosures. There are also several non-regulatory drivers pushing firms to obtain third-party assurance, including increasing concerns over greenwashing claims and consequential reputational risks. Verdantix sized this market in 2023, and estimated that its size is expected to grow at a 27% CAGR, reaching approximately $5.6 billion by 2027.

Is $1B revenue threshold for SB253 pertaining to a company’s overall revenue, not necessarily revenue in CA?

The legislation states that SB253 will apply to firms “with total annual revenues in excess of $1,000,000,000 and that do business in California.” More clarification from CARB on this matter could be expected within the coming year.

How are we expected to measure these and how do we prove reductions in CO2 and other GH gases?

Start by setting a baseline. A great place to start is by looking at your utility bills and onsite emissions and deciding on what emission factors you will apply for calculation. This will cover Scope 1 & 2 reporting.

Do you have to have all three or just one of the three for this to apply to your company?

(If referring to the regulations) Companies may be subject to all, some, or none of these regulations, depending on where they operate, how many employees they have, and their revenues.

Do we have (only) three “scopes” of GHG emissions because that is all that companies can report on?

In this webinar, we referred to only Scopes 1, 2 and 3 emissions to be consistent with the terminology used in these regulations. We refer to Scope 4 emissions (also known as avoided emissions) as potential GHG reductions achieved using a firm’s products or services relative to an alternative; because these are based on theoretical alternatives and theoretical emissions, they are harder to quantify and are, at this point, not required to be disclosed.

Will CSRD also apply to firms with over $1 Billion in revenue?

There are multiple levels of criteria that firms need to evaluate to see if they are subject to CSRD—it is not just based on revenue. For example, the first group of firms that is subject must meet at least two of the three requirements: 500 or more employees; 50 million EUR in net turnover; and 25 million EUR on balance sheet. For non-EU firms, which have a significant activity in the EU, generate over 150 million EUR in the EU and which have a subsidiary or branch on the territory of the EU which has a net turnover of more than 40 million EUR will also be subject, with reporting starting in 2028.

Is EnergyCAP SmartAnalytics usually used alongside BAS?

Yes! EnergyCAP SmartAnalytics (ESA) can integrate with your existing building automation systems. ESA is hardware and data agnostic, meaning is extremely flexible and can integrate with your current buildings to best meet your needs.

Are SB 253 $2B 261 likely to be adopted by other states who have adopted the CA Trading Program?

Previous legislation in California has had a rippling effect with other states—California’s previous clean-vehicle energy standards were adopted by states such as New Jersey, New York and Pennsylvania, and it is possible that some states will also follow California’s lead with climate-related legislation. For example, New York has already introduced a bill (S897A) that would require firms to disclosure Scope 1, 2 and 3 emissions, although this has yet to be voted on by the State Assembly or Senate.

Can you email the link to the self guided demo so I can share with other members on my team?

You can find the EnergyCAP CarbonHub self guided demo here.

Do any of your software products interface with any ERPs?

Yes, EnergyCAP solutions have flexible API integrates to meet your integration needs.

What is meant by limited assurance versus reasonable assurance. What does this mean in practice ?

Limited assurance has a more limited scope and requires less evidence collection than reasonable assurance. For limited assurance, a conclusion is framed in negative terms to provide the intended user with a lower level of confidence in its organization’s disclosures. Reasonable assurance is the highest level of assurance that can reasonably be obtained. To reduce the risk of material mis-statement to an acceptably low level, more evidence is collected and more tests are performed. This provides the intended user with a higher level of confidence in an organization’s disclosure on the subject matter.

Can you also comment on operability with the ISSB IFRS S1 and S2?

The ISSB has been working with different jurisdictions to increase interoperability between its standards and mandatory frameworks, including the SEC in the US and the European Commission and EFRAG in the EU.

Can you provide more light on LKSG (German Supply Chain Regulation) and CSDDD regulations?

LKSG requires firms to identify and act on human rights violations in their operations, including from their direct suppliers. CSDDD will require large firms headquartered or generating revenue in the EU to adopt due diligence policies and prevent or end adverse environmental and human rights in their operations and supply chains. Firms that fail to disclose sustainability performance face potential fines and legal actions. There are numerous other regulations targeting sustainability performance in the supply chain as well, such as the Uyghur Forced Labor Act in the US, the Child Labour Due Diligence Act in the Netherlands, and Bill S-211 in Canada.

How does EnergyCAP get integrated or aligned with more popular ERPs like SAP or Oracle ?

EnergyCAP solutions have flexible API integrates to meet your integration needs.

Can you further explain double materiality reporting, maybe share an example?

A double materiality assessment considers both financial materiality (e.g., impact on the value of the firm) and impact materiality (e.g., firm’s impact on society). For example, having strong policies for competitive behavior would be more significant from a financial perspective than from an impact perspective. Generally, the GRI framework is based on impact materiality while SASB is based on financial materiality.

What are your thoughts on Scope 4 emissions and how organizations can account for them?

We think Scope 4 emissions are important for a firm to think about, but we don’t expect them to be regulated any time soon due to their complexity and subjective decisions they require. Verdantix recently published a report focusing on this.

Want more information, or have further burning questions? Book a free meeting to talk with one of our experts today!

![Top 12 sustainability reporting platforms (ESG) [2026]](https://www.energycap.com/wp-content/uploads/2025/11/blog_thumb_top-sustainability-platforms.webp)